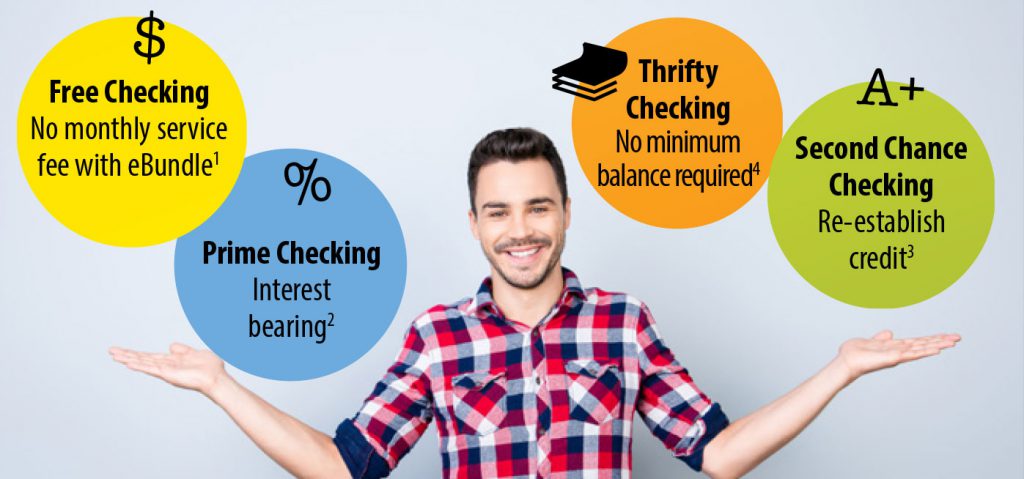

At USECU, we offer four different checking accounts to meet your individual financial needs. Each one offers a reward of your choice so you decide what works for you!

All USECU Checking Accounts feature:

- Unlimited check writing

- Debit MasterCard

- Free Online Access

- Free Mobile App

- Free Notary Service

- Free checking starter kit

- Bill Pay Services

Get a Checking Account with great rewards regardless of which checking you choose!

FREE Checking —

|

Prime Checking —

|

Thrifty Checking —

|

Second Chance Checking —

|

1 Free Checking takes $25 to open. No minimum balance requirement, and E-statements are required for Free Checking. 2 Prime Checking takes $100 to open and $750 minimum balance to avoid an $8.50 monthly service fee. Dividends are compounded and paid monthly. 3 Second Chance Checking takes $25 to open. There is a $9.95 per month service charge with a $3.00 rebate or reduction for those with direct deposit. 4 Thrifty Checking takes $25 to open and there is a $5 monthly service fee. 5 Bill Pay service fee is $5.95 per month.

Overdraft Protection and Privilege

We have two affordable options to cover an unexpected shortage of funds in your checking account. Overdraft Protection allows you to link your checking and savings to cover the shortage made by checks, pre-authorized debits, and bill payments, for a nominal transfer fee of $5. With Overdraft Privilege, we will cover your transaction if you run low on funds made by checks, pre-authorized debits, and bill payments, all for an affordable fee of $31. In addition, you can sign up to cover overdrafts on ATM and one-time debit card transactions for the same $31 fee. This is not a line of credit, however; if you inadvertently overdraw your account, USECU will have the discretion to pay the overdraft, subject to you Overdraft Privilege limit. An overdrawn balance must be repaid in 30 days. Mistakes happen, but we’ve got you covered – avoid the embarrassment of returned items and get the peace of mind that you deserve.

Direct Deposit

Direct Deposit means one less trip to the Credit Union to deposit your paychecks and no fear of losing your payroll check. Set up direct deposit with your employer and your paycheck will be automatically deposited into your checking or savings account. Your money will be right where you need it when you need it. It’s that easy!

Rates

*APY is Annual Percentage Yield. Deposit rates are effective as of October 1, 2024 and are subject to change. Prime Checking rate may change after account opening and fees may reduce earnings for this account.

Free Checking takes $25 to open. No minimum balance requirement, and E-statements are required for Free Checking. Prime Checking takes $100 to open and $750 minimum balance to avoid an $8.50 monthly service fee. Dividends are compounded and paid monthly. Second Chance Checking takes $25 to open. There is a $9.95 per month service charge with a $3.00 rebate or reduction for those with direct deposit. Thrifty Checking takes $25 to open and there is a $5 monthly service fee. Bill Pay service fee is $5.95 per month.

For additional information, contact a Member Service Representative at 713-595-3400 or send an email to: info@usecreditunion.com.